Centro de ayuda

Consejos y respuestas del equipo de EPROLO

Notice of Tax Collection for Customers without IOSS Num

Tax Collection is Available for Customers without IOSS Num

Dear Partner:

Cross-border VAT e-commerce is being modernized in the EU. The new rules will come into force on 1 July 2021 but preparation can start right now.

Regarding the new rule implemented, for orders shipped to EU countries, the IOSS Number is required.

For those orders placed on EPROLO after Jun. 24th, if you do not have an IOSS Number, to ensure that the product can be delivered to your customers, tax payable will be collected by EPROLO for your customs declaration.

For saving cost, it is recommended that you complete the IOSS number application and registration as soon as possible.

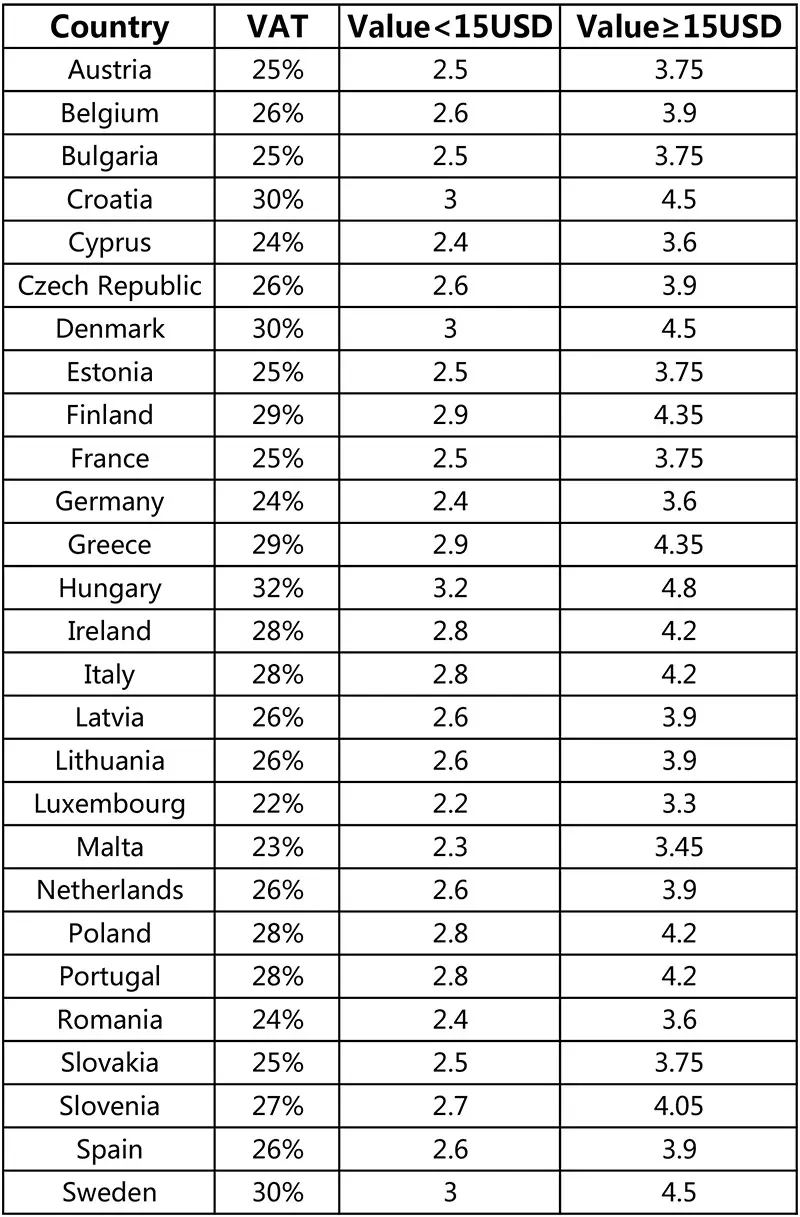

The tax calculation rule is that if the declared price of the products is greater than or equal to USD15, it shall be declared as USD15 and if less than USD15, it shall be declared as USD10.

Please kindly check the below table for your reference.

The Comparison Table of VAT Tax Rate Standard for EU Countries and Accordingly Estimated Tax Payable Amount

Kind Regards

EPROLO Team

June 22, 2021